Hurricane damage

Here in Florida, property insurance must go beyond a standard Homeowners policy. Because we experience hurricanes and tropical storms, windstorm and flood coverage are strongly recommended, and required when there is mortgage financing on your house or condominium.

Over the past few years, Florida property owners have been hit with significantly increased premium costs and even non-renewals from their insurance companies, leaving them scrambling to find coverage.

Due to higher property insurance costs, many Florida house and condominium owners are taking steps to mitigate (reduce) their exposure to risks that are covered by insurance.

In very general terms: Lower risk = Lower premiums

Speak with a Florida-licensed insurance agent for coverage, deductible, and exclusion details.

Hurricane / Named Storm and Windstorm are probably the most important coverages for Florida homeowners, and mitigating exposure to storm damage and loss could be one of the best ways to reduce your property insurance premiums. One of the easiest and least expensive ways to see if you can save money is to have a Wind Mitigation inspection performed on your property. It will document with photos and description the construction features of your residence that increase its resistance to damage from high winds.

Wind Mit inspections are often performed at the same time as 4-Point insurance inspections because they are closely related. Here is a direct link to my earlier article on 4-Points: 4-Point inspections may help reduce property insurance premiums (thefloridarealestateblog.com)

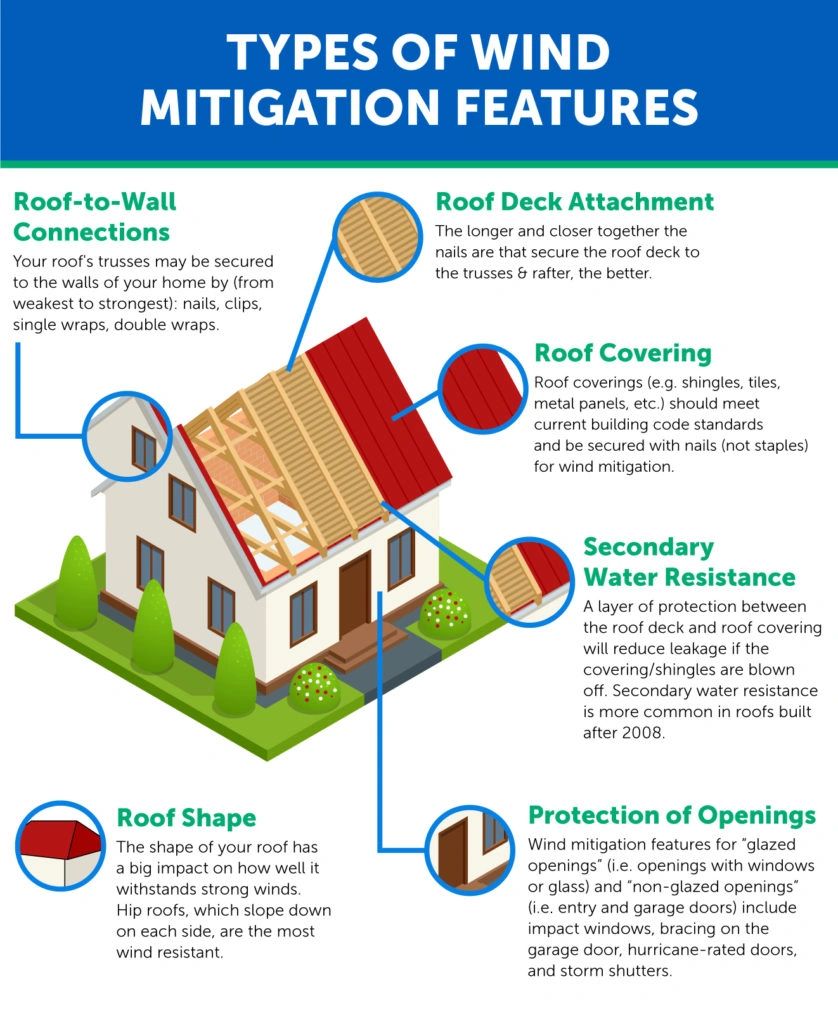

Factors that affect Hurricane & Windstorm premiums and discounts include:

- Roof Covering – type, age, building code & permit information. (Newer building codes include stronger standards for roofing.)

- Roof-Deck Attachment – nail/fastener size, type, & spacing

- Roof-to-Wall Attachment – number of nails (minimum 3 per attachment point preferred), type of metal straps, brackets, “clips”

- Roof Shape – hip roof preferred (4 sloping sides with no gable ends)

- Secondary Water Resistance – water-resistant polymer barrier on the plywood sheathing, protects from water intrusion if shingles or tiles are blown off

- Opening Protection – impact code-rated windows/doors, storm shutters

- Building Construction – Concrete block, wood frame, combination

Important – Hurricane / Named Storm and Windstorm coverages do NOT include Flood Insurance. Flood coverage is a separate risk which requires a separate policy.

Florida-licensed Home Inspectors, Building Contractors, Engineers, Architects, or Code Inspectors may perform the inspection and provide a standardized report to send your insurance company. With a current Wind Mit report, the company can determine if any premium discounts apply for helping mitigate potential insurance losses.

What do Wind Mitigation inspections and reports include? All of the above items that could result in insurance premium discounts!

The inspection form used to standardize Wind Mit reports is called the Uniform Mitigation Verification Inspection Form. Insurance companies won’t just take your word that your house has all the updates and preferred attachments that allow premium discounts. They need a trained, State-licensed person’s verification of physical inspection accompanied by a written report with photographs of inspected areas.

Here is a direct link to the complete Wind Mitigation form used by all Florida inspectors: WindMit (thefloridarealestateblog.com)

Wind Mitigation inspections for most Single-Family Homes are reasonably priced (often under $200), there are many Florida-licensed inspectors capable of performing them, and the premium savings can be noticeable. Many homeowners report annual savings of 15% and more.

Though it is not just about premium savings. Many homeowners use a Wind Mit report to perform upgrades strengthening their property’s storm resistance for safety and structural integrity reasons, viewing any resulting premium savings as a bonus.

Owners in low and mid-rise condominium buildings can also benefit from having Wind Mit inspections performed. The inspector will need to get into the attic or crawl-space area just under the roof to make a proper inspection, though will not have to enter each individual unit. Window and door code compliance and impact protection can be viewed from the outside. Inspections on these condo buildings cost more than those for SFHs.

High-rise condominium buildings have very different Hurricane / Windstorm considerations. Traditional Wind Mitigation inspections used for Single-Family Homes and low-rise condominium buildings do not apply to them. Though high-rise building insurers do perform inspections to evaluate a building’s resistance to storm force winds.

Wind Mit written reports are only valid for 5 years. Of course, if you have major roof repairs or a full roof replacement, you will need a new Wind Mitigation report so your insurance company knows you now have a better, stronger roof. Remember from above that newer building codes have stronger standards for all roof-related work, and recent repair or replacement must follow the newer building codes. This means you will probably be eligible for additional premium discounts based on a newer roof.

Even when you have a solid 5 year old roof in great condition, having a fresh Wind Mit report for your insurance company can keep current discounts in place. If you have never had one performed, it could be money well-spent by having one done now. The age of a roof will definitely affect any available premium discounts along with the level of coverage stated in the policy.

There we are, a quick outline of what a Wind Mitigation inspection covers, how it is used, and its place in helping homeowners receive insurance premium discounts. Speak with a Florida-licensed insurance agent for coverage, deductible, and exclusion details.

And speak with a licensed Home Inspector about having a Wind Mit inspection performed on your property. It could save you real money on your insurance premiums.

GET IN TOUCH

4445 US Hwy 17 W

Haines City, FL 33844

Office (863)421-2105

Shane (863) 589-8725

Cheryl (863) 206-8540

Shane@AmericanDreamRealty.info