A property Appraisal is needed any time mortgage financing is used to purchase residential real estate. Often, an Appraisal is ordered and everyone anxiously awaits the completed report since it may or may not support the already agreed-upon contract price.

An individual Appraiser’s local knowledge and experience contribute to the completed Appraisal report, though the entries in it must conform to certain standards in order to be consistent, dependable, and uniform. Standardized forms, categories, and methods allow Appraisal reports to realistically compare the market values of similar properties.

Appraisers look at the home or condo being evaluated (subject property), gather information on recent comparable sales (comps), then balance the differences and similarities between them to arrive at an opinion of the subject property’s current market value.

In Florida, professional property Appraisers are licensed by the Department of Business & Professional Regulation (DBPR).

It is very important to note that the Appraisers and Appraisals we are talking about today are NOT affiliated with any Florida County Appraisers Office. Licensed independent Appraisers are paid to provide opinions of market value for mortgage financing, the settling of estates, and insurance valuations. County Appraisers Offices establish taxable values for the calculation of annual property taxes.

Residential mortgage lenders require an independent Appraisal of value to determine the Loan-To-Value ratio, an integral part of their risk management. Basically, they need to verify that the contract price represents an accurate current market value for the property.

Lenders use the lower of contract price or Appraised Value when calculating LTV ratios. In an upcoming article, we will discuss what happens when an Appraisal comes in under the contract price.

Some cash buyers also have Appraisals performed within the purchase contract’s Due Diligence period in an effort to see how their offered price compares to a property’s Appraised Value.

To maintain the accuracy and quality of property Appraisals, the Uniform Appraisal Dataset was developed, which is a set of standards used to bring conformity and dependability to the Appraisal process. The UAD requires the use of standardized forms and establishes the definitions, abbreviations, ratings, methods, and entry formats used in the Appraisal report.

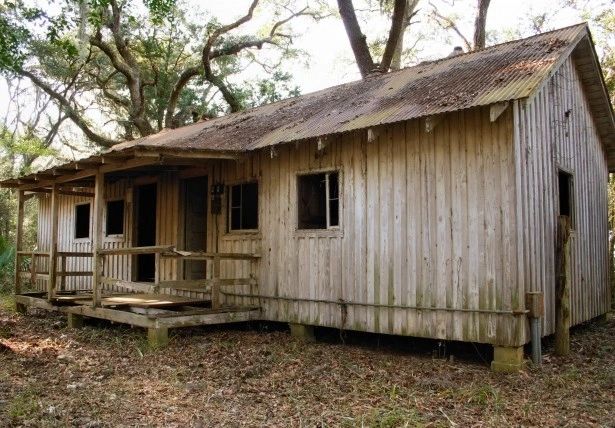

Let’s take a look at the UAD general Condition (C) and Quality (Q) categories:

- C1 – Recently constructed; not previously occupied; new components, fixtures, and mechanical systems

- C2 – No deferred maintenance; minimal physical deterioration; recently renovated or upgraded to current standards and style

- C3 – Well maintained; normal wear and tear; some (not all) components updated or renovated (first replacement cycle)

- C4 – Minor deferred maintenance; normal wear and tear; adequately maintained; minor repairs needed

- C5 – Obvious deferred or lack of maintenance; larger repairs needed; livability reduced due to condition

- C6 – Substantial damage; lack of maintenance; condition causes safety or structural concerns; major repairs needed

- Q1 – Architecturally designed or custom-built; extremely high quality materials, workmanship, finishes, fixtures

- Q2 – Often custom designed or highly upgraded/modified from basic plans, often in upper-level developments; high quality materials, workmanship, finishes, and fixtures

- Q3 – High quality construction; some upgrades from standard; above-average workmanship and materials; well finished

- Q4 – Standard design from available plans; code-compliant, builder grade workmanship, materials, and finishes; industry standard; few upgrades

- Q5 – Basic design and functionality; code compliant; below average workmanship, materials, and finishes

- Q6 – Basic quality/cost; may not be suitable for full-time occupancy; limited electrical, plumbing, mechanical systems; “DIY” type workmanship; possible safety issues

Categorizing the subject property as to general Condition and Quality using these recognized classifications is only the start of an Appraisal. The Appraiser goes into detailed analysis of the subject and all applicable comps in order to accurately present his/her opinion of the subject property’s value in relation to comparable properties recently sold.

Usable comps should be in the same general Condition and Quality categories as the subject property, and must be recent closed sales. Those sold and settled within the past 4 months and located in the same general neighborhood as the subject are considered most suitable for comparison.

Very few (if any) houses or individual condominium units are exactly the same as another, so the comparable recorded sale prices must be adjusted for features that are different from the subject property.

A subject property’s contract price cannot be changed for comparison purposes. Comparable properties’ previous sale prices are adjusted up or down in relation to the subject, then all values are compared.

Comp adjustments may be based on:

- Year built

- Lot size

- Square footage

- Room counts

- Upgrades (flooring, kitchen, bathrooms, HVAC, etc)

- Garage type and size

- On-property features (swimming pool, landscaping, etc)

And since transaction details directly influence a contract price, the following factors are also considered for both the subject and comps before arriving at a final Appraised Value:

- Seller concessions (contributing to buyers’ closing costs, financing charges, or community membership fees)

- Personal property included in the sale (furniture, vehicles, in-home electronics)

- Non-arms length sale (between relatives, business associates)

Any of these can be seen as motivation and inducement for the buyer to have made the purchase, potentially adding artificial value to the offer and contract price.

Here in Florida, Appraisals for individual condominium units are most accurate when comps in the same building or condo development are used. Most lenders prefer same-building or same-development condo comps to be used.

In HOA single-family home communities, comps within the subject’s same community are usually required. When not enough of them are available, sales from nearby communities are closely examined to see if they really are similar enough to be used as valid comps.

Lenders require a new Appraisal when the one being used for loan underwriting gets to be 120 days old. This is because local market trends are generally viewed from a rolling 120-day perspective.

Remember that Active, Pending, Withdrawn, and Terminated property listings cannot be used as comps in Appraisals. Only closed sales can be used as comparables when performing a residential Appraisal.

Some buyers may think that an Appraisal is similar to a Home Inspection. Nope, they are very different reports based on very different information, serving very different purposes.

Appraisal = Opinion of current market Value

Home Inspection = Detailed report on current property Condition